On June 12, 2017, Congressman Jim Sensenbrenner (R-WI) reintroduced into Congress H.R. 2887, also known as the “No Regulation Without Representation Act of 2017” (the “Legislation”), which codifies the physical presence nexus requirement established by the U.S. Supreme Court in Quill v. North Dakota, 504 U.S. 298 (1992) (“Quill”). The Legislation is interesting for several reasons: (1) it proposes to employ a result that is the exact opposite of the recent trend to overturn Quill; (2) it defines “tax” broadly to include net income and business activity taxes; and (3) it expands the law to require a physical presence for states to regulate a person’s activity in interstate commerce outside of the tax context.

Summary of the Legislation

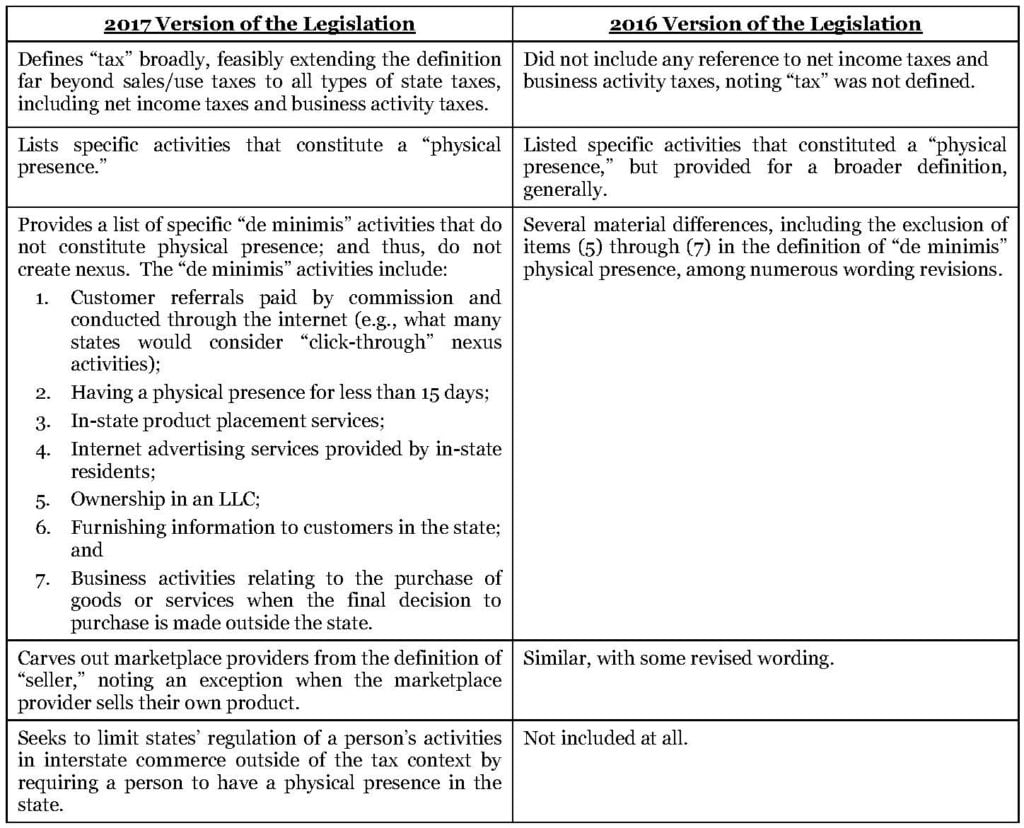

The Legislation provides that “a State may tax or regulate a person’s activity in interstate commerce only when such person is physically present in the State during the period in which the tax or regulation is imposed.” Section 2(a) of H.R. 2887 (emphasis added). Additionally, in the below chart, we have summarized key components of the Legislation, along with providing a high-level comparison to the prior version, which Congressman Sensenbrenner introduced in 2016 and died at the end of the legislative session. A redline comparing the 2016 version to the 2017 version can be viewed here.

Insight

The Legislation is not the federal solution many U.S. lawmakers and states have previously proposed. With respect to the tax portion of the Legislation, the trend has been to kill Quill, not nurture it. Just this year two other federal bills were introduced into Congress – the Marketplace Fairness Act of 2017 and the Remote Transactions Parity Act of 2017– and there have numerous similar laws proposed in the past. In addition many states have also joined the fight by introducing laws, regulations, and/or administrative directives that directly contradict the Quill physical presence requirement (e.g., South Dakota, Alabama, and Tennessee). We can’t forget Justice Kennedy’s famous concurring opinion in Direct Marketing Association v. Brohl, 135 S. Ct. 1124, 1135 (2015): “The legal system should find an appropriate case for this Court to reexamine Quill.” And even the President recently took to Twitter to say that remote sellers should be paying “internet taxes,” a reference that could feasibly be interpreted to mean sales tax on internet sales, although not clear. To read more about the “kill-Quill” movement, please see our prior coverage “Is the Kill-Quill Movement Gaining Momentum?”

Additionally, the implications of this Legislation, if enacted, appear to be far broader than simply codifying Quill through the expansive definition of “tax” to the specified “de minimis” activities. For example, the Legislation could: (1) limit currently-enacted rules establishing a sales tax presence (e.g., click-through nexus laws); (2) shift the way states impose their income taxes (e.g., economic nexus); (3) affect gross receipts taxes or other similar state tax laws; and (4) limit the regulation of interstate commerce outside of the tax context, noting that this provision may be the first of its kind. Although the effect could be widespread, the Legislation raises several questions for both states and taxpayers. Aside from the obvious questions as to how the Legislation will be interpreted and applied, many broader questions can be raised. For example, is the renewed Legislation a sign that the momentum for killing Quill is slowing? Will the Legislation be able to obtain state support? Can state budgets balance the fiscal implications? How will this affect the federal, state, and local economies?

Although the answers to these questions are anyone’s guess, we are confident that many states are likely to be against the Legislation, particularly with the recent attempts to move forward bills that propose the exact opposite sales tax nexus standard and create rules/regulations promoting economic nexus across all tax types. However, retailers are likely to come out across the spectrum, depending on their business model. While the passage of this Legislation in the near-term may seem unlikely, only time will tell what ultimately happens with state tax nexus.

Contact the author: David Pope